Electric Car Boom Threatens Florida’s Gas Tax Revenue

TALLAHASSEE – As electric vehicles (EVs) gain popularity among motorists, Florida faces a potential challenge to its gasoline tax revenue, a significant source of funding for transportation projects. State economists have conducted an analysis, shedding light on the potential impact of increasing EV adoption.

The analysis, crafted by the state’s Revenue Estimating Conference, indicates that over the next decade, the market share of electric vehicles in Florida is projected to notably rise. Several factors contribute to this shift, including more affordable EV prices, wider availability of charging stations, and improved battery longevity.

The rise in electric vehicle ownership has implications for gas tax collections. As more vehicle owners transition to EVs, the ongoing decline in gas tax revenue could reduce the primary source of funding for transportation projects in the state.

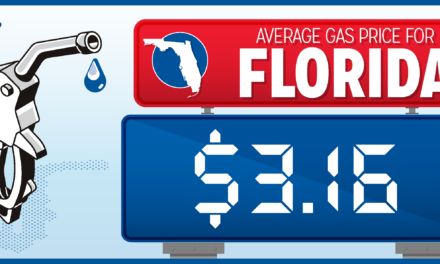

Currently, Florida gathers approximately 25 cents per gallon in gas taxes. Economists rely on a metric known as “fleet miles per gallon” to forecast fuel consumption and tax revenues. The analysis highlights that electric vehicles still constitute a relatively small portion of the overall vehicle fleets in Florida and across the U.S.

While the influence of electric vehicles on new vehicle fuel efficiency is on the horizon, it’s important to recognize a lag of at least five to seven years before this impact is visible across the entire fleet. This delay arises because the transition from gas-powered vehicles to electric vehicles will unfold over several years. Existing gas-powered vehicles on the road are likely to remain in use for 10 to 15 more years. Moreover, factors like improved fuel efficiency in gas-powered vehicles and the balance between light and heavy vehicles also contribute to fuel economy trends.”

Angela Small

Radio Production Assistant