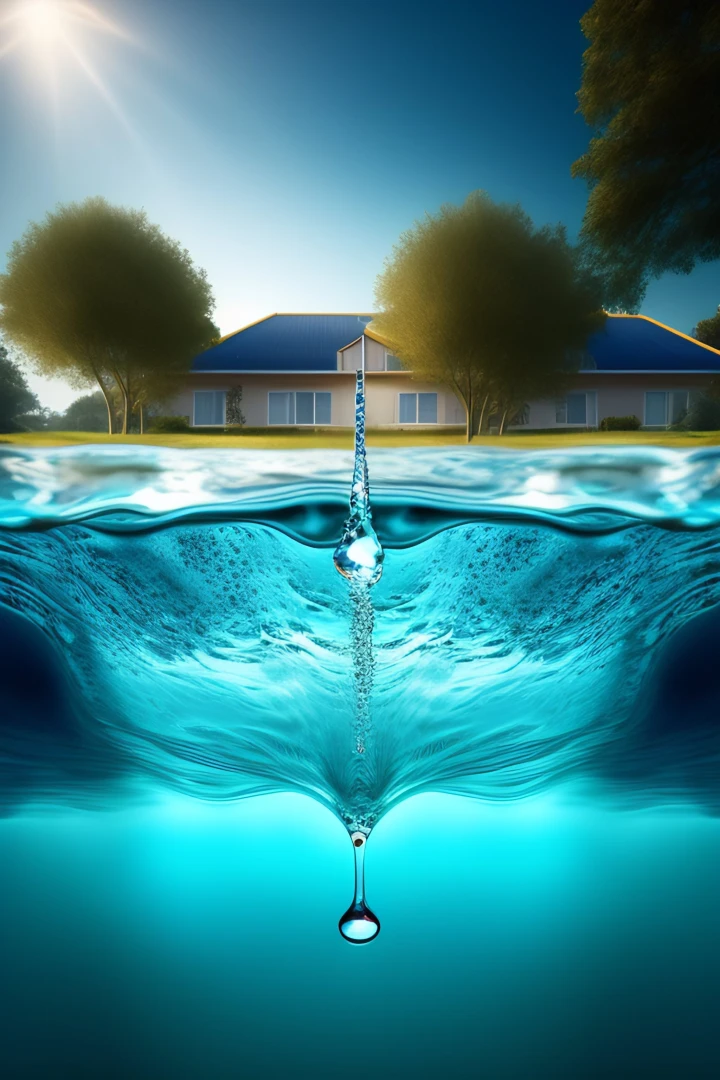

Assessing Septic Tank Risks in Florida

Florida TaxWatch Assesses Risks of Conventional Septic Tanks, Provides Recommendations for Improving Florida’s Wastewater Management

Tallahassee, Fla. – Florida TaxWatch (FTW) released Septic-to-Sewer: Protecting Florida’s Ground and Surface Water. The report builds upon FTW’s previous research to assess the risks of conventional septic tanks and provide recommendations for improving Florida’s wastewater management.

Florida TaxWatch President and CEO Dominic M. Calabro said, “Florida has reached a critical point in its relationship with water. To sustain recent population growth, the state must invest in converting and enhancing septic systems and also maintaining its water infrastructure. And while a considerable $941 million has been allocated to the Wastewater Grant Program since 2021, Florida TaxWatch questions if it is enough. We offer this report to state leaders and legislators – who are responsible for ensuring taxpayers have continued access to high-quality water for health, enjoyment, and economic activities – with the hope that it will help them develop and enact thoughtful, innovative policy to improve wastewater management.”

To prevent groundwater, or drinking water, contamination, septic tanks should be inspected every one to three years and replaced within 20 to 30 years. However, a 2008 study from the Florida Department of Health suggested more than half of the state’s active onsite sewage treatment and disposal systems (OSTDSs), which use septic tanks and drain fields to treat wastewater, were more than 30 years old, and less than one percent operated with permits that facilitate inspections and routine maintenance. Fifteen years later, the remaining septic tanks are older and now more prone to failures.

Despite the risks, OSTDSs are prolific across Florida. The state prioritizes centralized sewer systems, but areas with many septic tanks either lack the wastewater infrastructure or financial capacity to connect to these systems. About 2.1 to 2.6 million conventional OSTDSs are active in the state, treating wastewater for about 30 percent of the population. The five counties with the greatest number of estimated septic tanks are: Polk (118,000), Columbia (117,00), Miami-Dade (107,000), Marion (100,000), and Lee (97,000).

Since 2016, a series of state legislation has increased oversight of OSTDSs located near key water resources, and multiple loan and grant programs, such as the Wastewater Grant Program, have been created to assist in the development of wastewater infrastructure beyond these protected areas. Member projects have increased as well, and while individual projects may be worthwhile, they circumvent comprehensive, statewide selection processes that are designed to fund the highest priority projects. In fact, during the 2023 Legislative Session, 21 of these local water projects were septic-to-sewer conversions, costing $37.8 million, but if that same amount had been added to the Wastewater Grant Program instead, it would have increased the program’s total funding by about 19 percent.

To improve Florida’s wastewater management, FTW provides four recommendations, including passing legislation that incorporates provisions of Executive Order 23-06 into Florida Statues; requiring enhanced nutrient-reducing technology for septic tanks, where central sewer is not possible; developing and implementing a septic tank inspection and monitoring program; and creating a comprehensive five-year work program to develop water and wastewater infrastructure statewide – a recommendation that will be expanded upon in future FTW research.

To learn more and access the full report, please click here.

About Florida TaxWatchAs an independent, nonpartisan, nonprofit government watchdog and taxpayer research institute for more than forty years and the trusted eyes and ears of Florida taxpayers, Florida TaxWatch works to improve the productivity and accountability of Florida government. Its research recommends productivity enhancements and explains the statewide impact of fiscal and economic policies and practices on taxpayers and businesses. Florida TaxWatch is supported by its membership via voluntary, tax-deductible donations and private grants. Donations provide a solid, lasting foundation that has enabled Florida TaxWatch to bring about a more effective, responsive government that is more accountable to, and productive for, the taxpayers it serves since 1979. For more information, please visit www.floridataxwatch.org.

Angela Small

Radio Production Assistant